Recent comments from Nvidia CEO Jensen Huang have cast new light on the state of global AI competition. “China is not behind. I mean, they’re right behind us. We’re very, very close,” Huang stated in a recent interview, surprising many who had assumed a wider gap between US and Chinese AI capabilities.

The Rapid Closing of the Gap

The Stanford AI Index confirms what Huang suggests – the US lead over China is quickly shrinking. While US institutions produced 40 notable AI models in 2024 compared to 15 from China, Chinese models have caught up in quality at an astonishing rate.

On the LMSYS chatbot arena benchmark, which measures human opinions of AI models, the gap between US and Chinese models has narrowed from around 150 points to just 20 points. This rapid progress has caught even seasoned tech leaders off guard.

Former Google CEO Eric Schmidt exemplifies this shift in perception. In early 2024, Schmidt claimed the US was “two to three years ahead” of China in AI development. Less than a year later, after seeing models like DeepSeek, he revised his assessment: “It looks to me like it’s within a year now.”

Beyond the Benchmarks

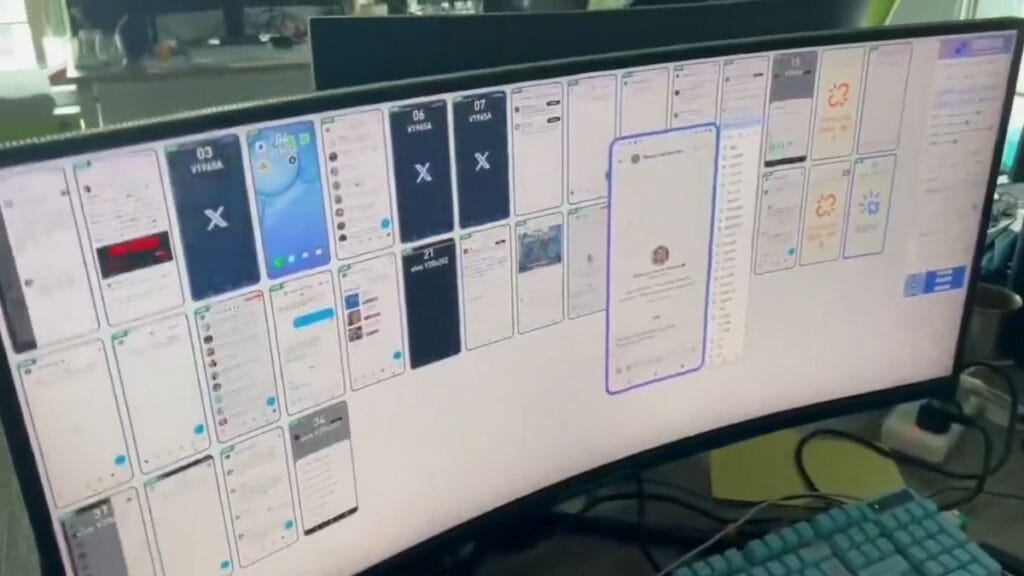

While benchmarks show a narrowing gap, real-world usage reveals important distinctions that numbers alone don’t capture. As someone who works with these models daily, I can attest that differences still exist between top-tier models like Claude 3.7 Sonnet and open-source alternatives from China.

Yet recent Chinese models like Quen 3 are changing this story. Despite being released just days ago, Quen 3 performs comparably to Gemini 2.5 Pro on some benchmarks. Its math capabilities and reasoning skills make it a viable option for many professional tasks.

What’s most striking is how these models perform in actual use cases rather than just exam-style benchmarks. Raw intelligence scores don’t always translate to usefulness for specific industry tasks. Some Chinese models excel in practical applications despite not topping every leaderboard.

How GPU Restrictions Are Backfiring

The US strategy to maintain AI dominance has centered on restricting China’s access to advanced GPUs. The government has blocked even downgraded versions like Nvidia’s H20, designed specifically for the Chinese market while complying with earlier restrictions.

These moves cost US companies like Nvidia billions ($5.5 billion in written-off GPUs), but may have unintended consequences. Rather than stopping China’s progress, these restrictions have pushed Chinese companies to:

- Stockpile chips ($16 billion worth)

- Develop more efficient AI training methods that require less compute

- Accelerate domestic chip development

Huawei’s recent Ascend 910C and 910D processors demonstrate this last point. These chips now account for over 75% of AI chips produced in China, providing an alternative to Nvidia GPUs. While they may not yet match Nvidia’s top offerings in pure performance, the capability gap is closing fast.

What This Means For Tech Professionals

For those working in AI and related fields, China’s progress has several practical implications:

Access to Open-Source Models: Chinese companies are releasing powerful open-source models like DeepSeek and Quen 3. These free alternatives can cut costs for startups and small businesses that can’t afford commercial API fees.

Hardware Diversification: As Huawei and other Chinese firms improve their chips, the AI hardware landscape will become less Nvidia-dependent. This could eventually lead to more options and better pricing.

Job Market Changes: Skills in optimizing AI for different hardware architectures will grow more valuable as the market diversifies. Experience with both Western and Chinese AI frameworks will be an asset.

Data Practices: Different AI ecosystems may develop distinct approaches to data handling. Professionals should stay aware of these differences when selecting models for sensitive applications.

Security Considerations: As Eric Schmidt warned, the race has national security implications. Tech professionals working in sensitive areas should stay informed about which models they’re using and where they were developed.

The Path Forward

This isn’t just about which country “wins” – the race is what Jensen Huang called “infinite.” There’s no finish line, and both ecosystems will likely continue to develop in parallel.

For businesses and tech professionals, the smart approach is to:

- Stay flexible and avoid locking into single-vendor AI solutions

- Test multiple models for your specific use cases rather than relying solely on benchmark scores

- Build workflows that can adapt as the AI landscape evolves

- Consider the total cost of ownership, including compute requirements, not just raw performance

The narrowing gap between US and Chinese AI capabilities presents both challenges and opportunities. By staying informed and adaptable, tech professionals can make the most of advances from both ecosystems while navigating the complex strategic landscape.

What matters most isn’t which country leads on paper, but how these tools can solve real problems. The coming years will be less about where AI is built and more about how we put it to work.

Does your organization need help assessing which AI models best fit your specific needs? What steps are you taking to stay adaptable in this fast-changing field?