The Rise of Perfect Digital Forgeries

The recent update to ChatGPT’s image generation features has created a new challenge for businesses: AI systems can now create highly convincing fake receipts. With just a few prompts, users can generate realistic-looking restaurant bills, complete with logos, addresses, and seemingly valid calculations. While some early examples contain small errors like comma placement or incorrect math, these are easily fixed with better prompts or minor editing.

This development marks a turning point in document verification. Images that were once considered reliable proof of purchases or expenses can now be created by anyone with access to ChatGPT’s 4o model. For businesses that rely on receipt verification for expense reports, returns, or reimbursements, this creates an urgent security problem that requires immediate attention.

Why This Matters More Than Previous Fake Documents

Fake documents aren’t new, but AI-generated receipts present unique challenges:

Speed and scale: Anyone can create dozens of fake receipts in minutes without special skills.

High quality: The receipts include realistic details like logos, line items, tax calculations, and even coffee stains or wrinkles for added authenticity.

Low cost: Unlike previous forgery methods that required specialized knowledge or tools, these fakes can be created at no cost by anyone.

Metadata limitations: While OpenAI embeds metadata in generated images, this can be removed by taking screenshots or printing and rescanning the documents.

A LinkedIn user demonstrated this by creating a crumpled French restaurant receipt that looked nearly identical to an authentic one. TechCrunch reporters were able to create fake Applebee’s receipts with only minor flaws. As prompting techniques improve, these small errors will likely disappear.

The Real Business Risks

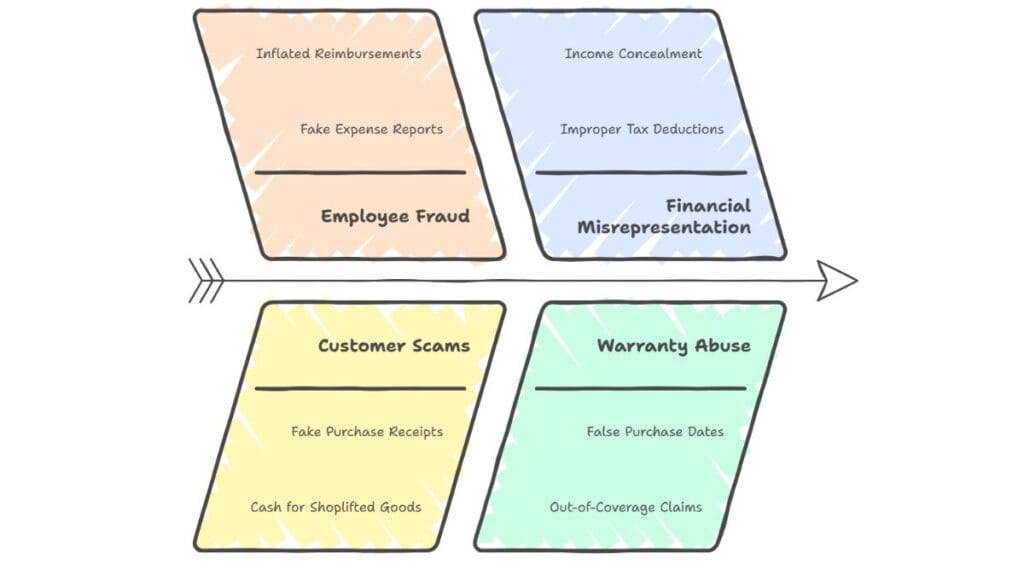

For businesses, the risks extend beyond just fraudulent reimbursements:

Employee expense fraud: Staff could submit fake receipts for meals, supplies, or services that never occurred.

Customer return scams: Shoppers might generate fake purchase receipts to return items they never bought or to get cash for shoplifted merchandise.

Tax and accounting issues: Fake receipts could be used to claim improper tax deductions or hide income.

Insurance claims: Fraudsters might submit fake receipts for items allegedly damaged or stolen to collect insurance payouts.

Warranty exploitation: Consumers could create receipts with false purchase dates to claim warranty service on items outside their coverage period.

The financial impact could be substantial. The Association of Certified Fraud Examiners estimates that businesses lose about 5% of revenue to fraud annually, and these new tools could push that number higher.

Technical Verification Solutions

Businesses need to adapt their verification systems to address this new threat. Some practical approaches include:

Metadata verification: OpenAI spokesperson Taya Christianson confirmed that all ChatGPT-generated images include embedded metadata. Businesses can implement systems that check for this C2PA (Content Authenticity Initiative) metadata.

Math validation: Implement automated systems that check if the calculations on receipts are mathematically correct, as AI systems still sometimes make computational errors.

Database cross-referencing: For major purchases, verify the transaction in your payment processor records instead of relying solely on receipt images.

Digital receipt systems: Move toward digital receipt delivery systems that create verifiable transaction records in your database.

Multi-factor verification: For large expenses, require additional proof beyond just receipt images.

Machine learning detection: Train systems to spot patterns common in AI-generated receipts, which often have subtle but detectable differences from authentic ones.

Policy and Process Updates Needed

Beyond technical solutions, businesses need to update their policies:

Expense policy revisions: Update your expense policies to specify acceptable forms of proof for reimbursement.

Staff training: Train accounting and customer service staff on spotting AI-generated receipts.

Clear consequences: Establish and communicate clear consequences for submitting fraudulent documentation.

Random audits: Implement a system of random verification checks rather than reviewing every receipt.

Vendor relationships: Establish direct data-sharing relationships with frequent vendors to verify purchases without relying on receipts.

The Broader Trend: Document Verification in the AI Era

This development is part of a larger shift in how we verify information. As AI makes it easier to create convincing fakes, our systems for establishing truth need to evolve.

Traditional document verification relied on the difficulty of creating convincing forgeries. Now, verification must shift to cryptographic signing, database cross-referencing, and chain-of-custody tracking.

Some forward-thinking companies are already moving toward blockchain-based verification systems that create immutable records of transactions. Others are adopting QR codes that link to verifiable database entries rather than relying on the document itself as proof.

What’s Coming Next?

The ability to generate fake receipts is just the beginning. Future AI models will likely generate even more convincing documents, including:

Multi-page documents: Complete with consistent details across pages.

Interactive digital documents: PDFs with working forms and calculations.

Document sets: Related documents that cross-reference each other.

Businesses that adapt quickly will be less vulnerable to these emerging threats. Those that continue to rely on traditional document verification systems face increasing fraud risks.

Preparing Your Business

To protect your business from AI-generated fake receipts:

Audit current verification processes: Identify where you rely on document images as proof.

Implement technical checks: Add metadata verification and mathematical validation.

Update policies: Clearly define acceptable documentation and verification requirements.

Consider verification services: Third-party services can help verify the authenticity of submitted documents.

Plan for the future: Recognize that this challenge will evolve, and build flexibility into your verification systems.

The era of trusting document images as proof is ending. Businesses that adapt quickly will protect themselves from fraud while those that ignore this shift face growing vulnerability to increasingly sophisticated AI-generated fakes.